General Fund

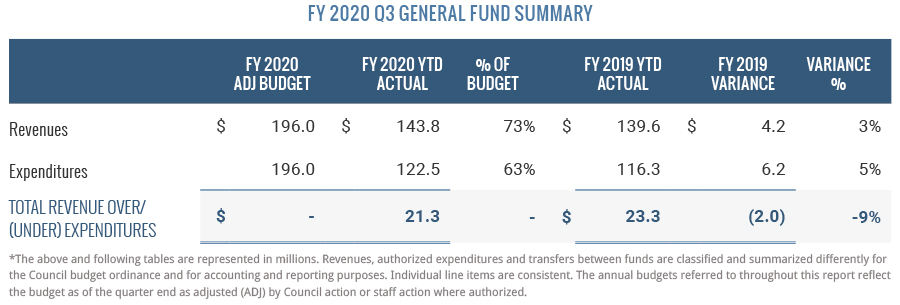

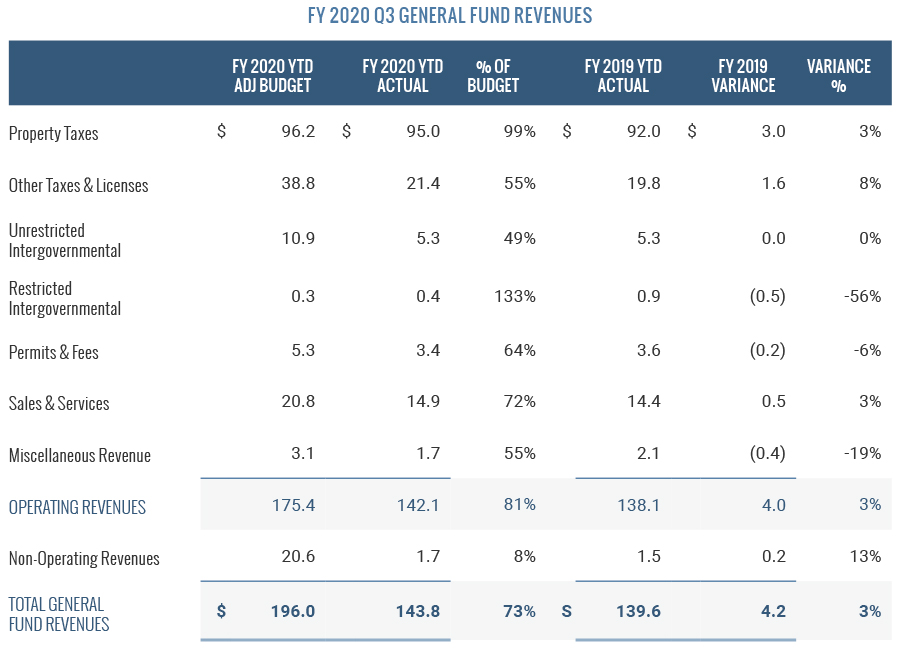

Overall net results for Q3 are relatively consistent with prior years’ third quarter and budget. The net $2 million variance from FY 2019 is 1 percent of the total budget. Given the volume of refunds for Parks, Recreation and Cultural Resources programs and rentals after quarter end, these revenues are overstated. Details on notable revenues and expenditures by category follow.

Total General Fund revenues have been strong thanks to robust sales tax revenues and continued growth in the property tax base. These figures do not reflect parks, recreation and cultural resource program and rental refunds resulting from the governor’s stay-at-home order; therefore, these revenues are overstated.

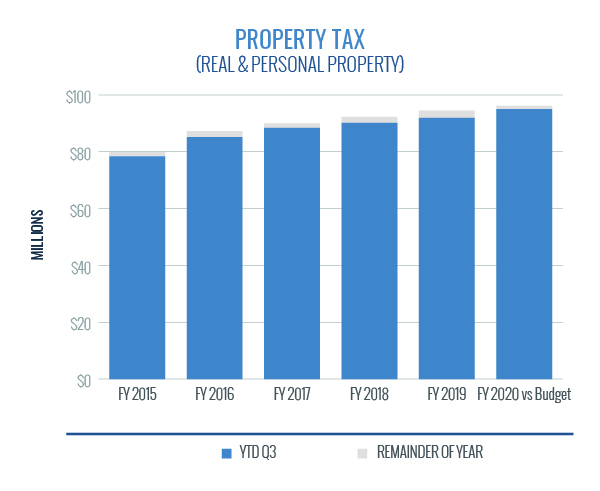

Property Tax

Property tax revenue is 54 percent of total budgeted operating revenue and is the largest single revenue source for the General Fund. Taxes are based on an ad valorem tax levy on real property and personal property. Real property includes land and buildings, and personal property primarily includes vehicles and commercial business equipment. Real property taxes were billed in July 2019 and were due no later than January 6, 2020. Most real property tax revenue is received during Q2. Conversely, most personal property tax revenue is collected throughout the year based on the State of North Carolina’s Tax and Tag program, which combines the vehicle ad valorem tax collection with the State’s vehicle license renewal process.

The FY 2020 budget for real property tax is $90.1 million. As of Q3, Cary has received $90.4 million, or 100 percent of the real property tax budget. Collections increased $2.7 million, or 3 percent, compared to the same period in FY 2019. The FY 2020 budget for personal property tax is $6.1 million. As of Q3, Cary has received $4.6 million, or 75 percent, of the personal property tax budget, a 7 percent increase from the same time in FY 2019. Real and personal property tax revenues total $95 million at the end of Q3, which is $1.2 million under budget. Given the impact of the pandemic on Q4 personal property revenues for vehicles, there is a risk that the total property tax receipts will not meet budget.

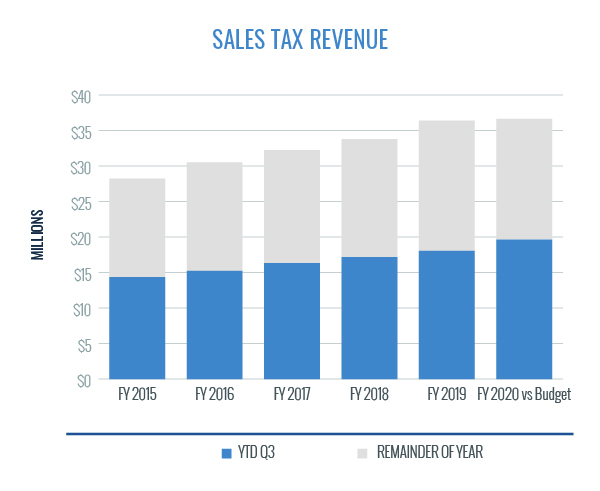

Sales Tax

Sales tax makes up 21 percent of budgeted General Fund operating revenue and is a component of the category of Other Taxes & Licenses. A strong economy in the first six months of the fiscal year contributed to 9 percent growth in sales tax, or $1.6 million, compared to the same time last year. This revenue stream is distributed to municipalities by the NC Department of Revenue approximately two and a half months after the month when taxable sales occurred. Through Q3, Cary has received six distributions for July through December sales. The pandemic’s impact on taxable sales in the last two weeks of the third quarter and all the fourth quarter is expected to be dramatic, but the effect on Cary’s finances will not be known until after fiscal year end.

Governmental Revenue

Intergovernmental revenue makes up 6 percent of total budgeted General Fund operating revenues. Sales taxes on electricity, natural gas and wireless communications comprise 91 percent of the budgeted revenue sources in this category. Utility sales taxes are budgeted at $10.2 million in FY 2020. The state distributes utility sales tax revenue in December, March, June and September. Cary received a total of $5.3 million for the first two distributions for the year. These distributions are practically equal to the distributions year to date in FY 2019 and, prior to the pandemic restrictions, were on target to meet budget. Revenues in the Restricted Intergovernmental category decreased 56 percent in Q3 FY 2020 compared to the same period in FY 2019 because of a $500,000 decrease in police-related Federal Forfeiture funds.

Sales and Service

The increase in Sales and Service revenue is primarily the result of the sanitation fee increase of $2.50 per month to address the increased cost of recycling. This increase is reflected in the FY 2020 budget. The impact of stay-at-home orders on parks, recreation and cultural resources revenue is still being analyzed. The recognition of revenue through the implementation of the MyCary system and the volume of refunds has required extensive work that is not yet complete.

Other Revenue

Non-operating revenue increased 13 percent in FY 2020 compared to FY 2019 due to an increase in investment earnings.

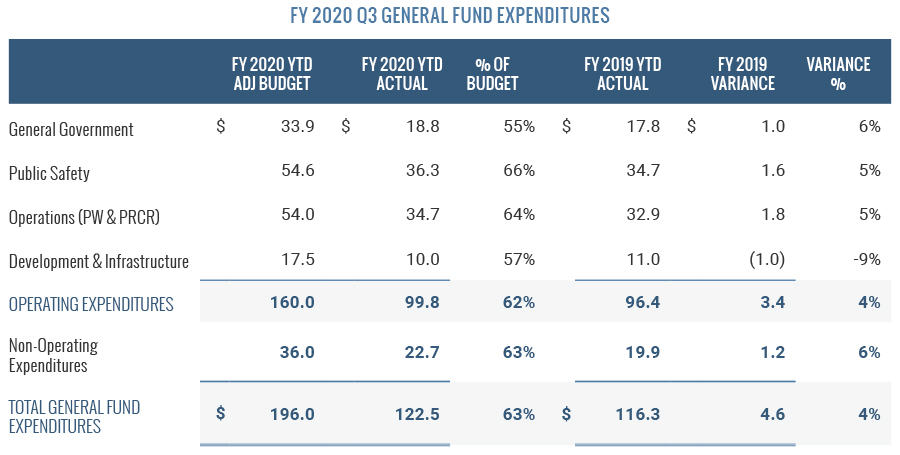

The 4 percent increase in operating expenses reflects budgeted increases for technology, recycling and salaries and benefits for 12 firefighters hired in the second half of FY 2019.

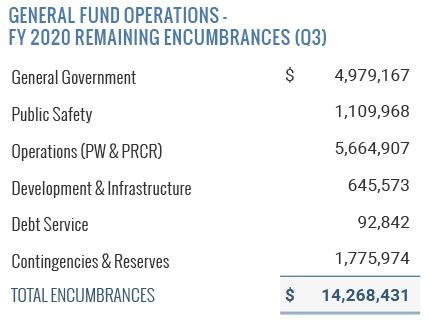

Encumbrances represent funds that have been reserved in the accounting system to cover existing purchase commitments. The table to the right shows the total outstanding encumbrances in the Town’s financial system at the end of Q3. When including these encumbrance amounts with year-to-date spending amounts, the General Fund has over $41 million available in the operating budget to cover expenditures for the remainder of the fiscal year.