General Fund

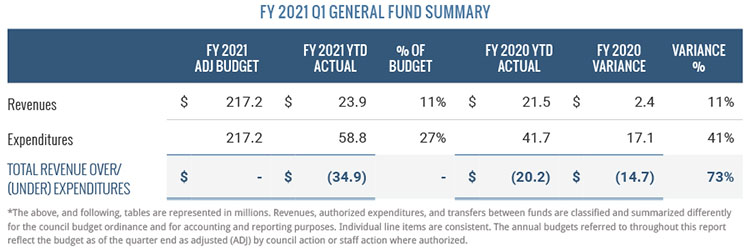

Overall, expenditures surpassed revenues by 73% when compared to the prior year. First quarter results are consistent with historical results as expenditures outpace revenues in the first quarter because revenues are not received evenly throughout the year. Expenditures are significantly higher in Q1 of FY 2021 compared to prior year’s Q1 due to an increase in transfers to capital projects.

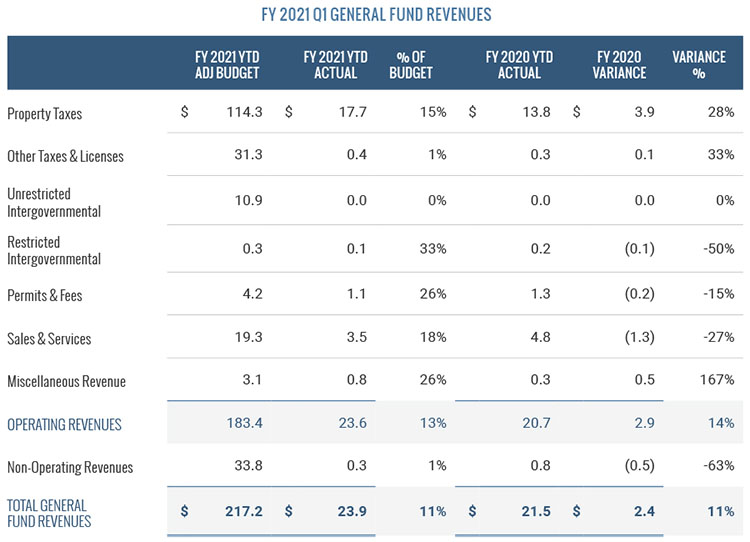

Overall, FY 2021 General Fund revenues are up $2.4 million, or 11%, over the same period in FY 2020 primarily due to an increase in property tax revenues.

Operating Revenues

Property tax revenue is 53% of total budgeted revenue and is the largest revenue source for the General Fund. Taxes are based on an ad valorem tax levy on real and personal property. Real property are items such as land and buildings, while personal property are items such as vehicles and commercial business equipment. Real property taxes were billed in July 2020 and are due no later than January 6, 2021. Therefore, most real property tax revenue is received during Q2. Conversely, personal property tax revenue is collected throughout the year based on the State of North Carolina’s Tax and Tag program, which combines the vehicle ad valorem tax collection with the state’s vehicle license renewal process. About $17.7 million was received in both real and personal property tax revenue in Q1 of FY 2021, which is a 28% increase over the same period last year. The Wake County property tax revaluation that took effect January 1, 2020, in combination with Cary maintaining its $0.35 tax rate for the current fiscal year, account for the year-over-year increase.

The 33% increase in the Other Taxes and Licenses category is due to the timing of the receipt of occupancy tax revenues. In FY 2021, Cary received the occupancy tax in Q1, while in FY 2020, the first distribution was received in Q2.

Restricted Intergovernmental revenues decreased 50% compared to the prior year due to the decline in school resource officer revenue. Due to the pandemic’s impact on Wake County Public Schools, virtual learning replaced the need to have resource officers working at the schools. Therefore, Wake County has not been billed for these services.

The 15% decrease in Permits and Fees is due to a variance in the composition of construction types and permits rather than the pandemic. While permits for all types of construction increased by 1%, lower construction value associated with those permits caused revenues to decrease. Although permit and fee revenues have declined, this was anticipated during the FY 2021 budget process. As a result, these revenues are in line with budget.

Sales and Services decreased by 27% in Q1 of FY 2021 compared to Q1 of FY 2020. About $1.7 million of this decline is due to the closure of facilities, rentals, and camps related to Parks, Recreation, and Cultural Resources (PRCR) activities to limit the spread of COVID-19. The FY 2021 Adopted Budget anticipated a 20% decline in PRCR revenues compared to FY 2020.

The variance regarding the Miscellaneous Revenues category is related to the timing of the receipt of revenue.

Non-Operating Revenues

Non-operating revenues declined by 63% in Q1 of FY 2021 compared to Q1 of FY 2020 primarily due to decreased bond proceeds and investment earnings. Quarterly investment earnings decreased by $135,000 in FY 2021.

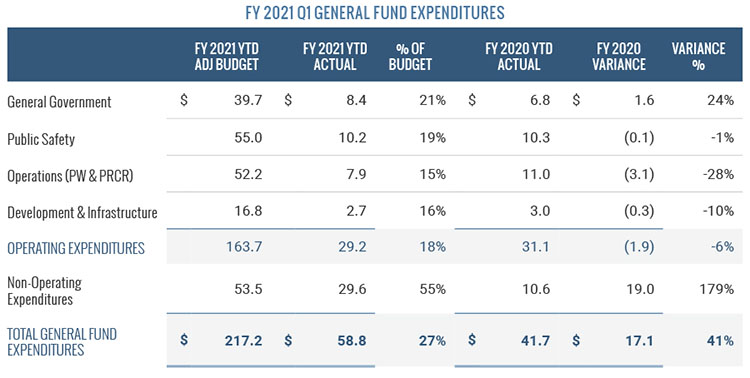

First quarter expenditure variances are primarily due to the impact of the pandemic on operations. Decreases in operations, as well as development and infrastructure expenditures, are the result of operational precautions to prevent the spread of COVID-19. Due to the temporary closure of facilities and a temporary hold on in-person camp/sports programming, costs associated with PRCR programming, such as temporary salaries, expenditures associated with camps, and maintenance on facilities, are down compared to the prior fiscal year. Cary continues to adapt to these limitations and adjust operations as the fiscal year progresses. The variance in General Government is due to the timing of payments for software maintenance and renewals in Marketing and Information Technology. The increase in non-operating expenditures reflects increased transfers to various capital projects in FY 2021.

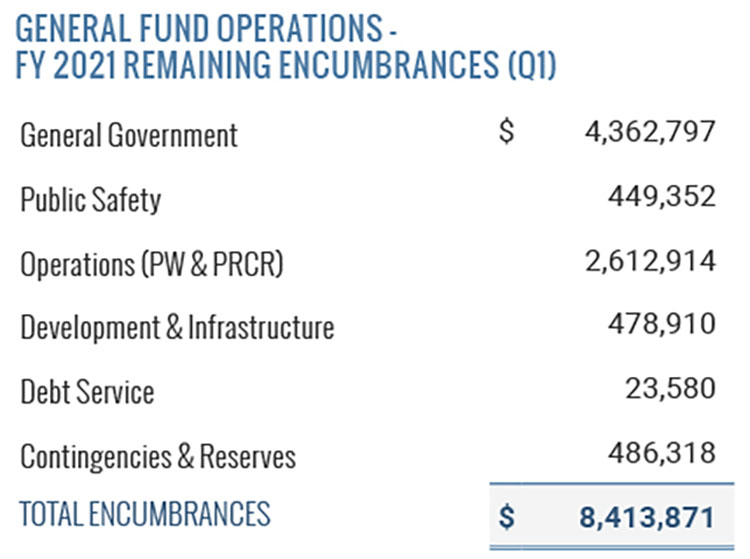

Encumbrances represent funds that have been reserved in the reporting system to satisfy a commitment to make a purchase. The following table shows the total outstanding encumbrances that are remaining at the end of Q1. When including these encumbrance amounts with year-to-date spending, the General Fund has nearly $150 million in the operations budget for the remainder of the year.