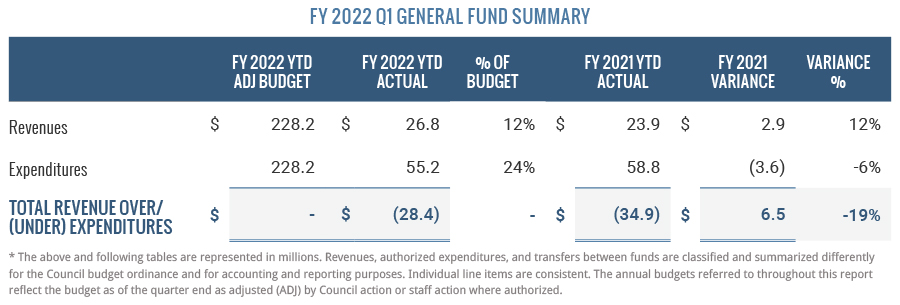

Overall, expenditures surpassed revenues this quarter. This is expected and consistent with prior years as revenues are not received evenly over the year. Expenditures decreased overall by 6% due to a $6 million decrease in non-operating expenditures.

Overall, FY 2022 General Fund revenues increased 12% compared with the same period in FY 2021. Revenues often fluctuate year to year due to the timing of allocations from state and federal sources.

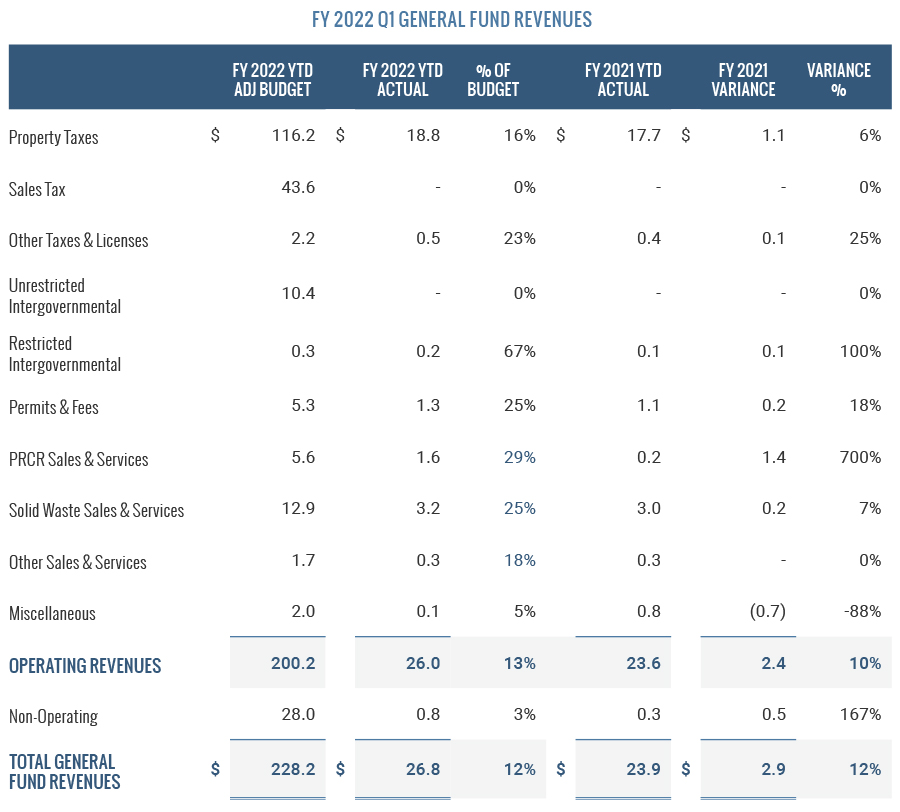

Operating Revenues

Property Tax revenue is 51% of total budgeted revenue and is the largest revenue source for the General Fund. Taxes are based on an ad valorem tax levy on real and personal property. Real property are items such as land and buildings, while personal property are items such as vehicles and commercial business equipment. Real property taxes were billed in July 2021 and are due no later than Jan. 5, 2022. Therefore, most real property tax revenue will be received during Q2. Conversely, personal property tax revenue is collected throughout the year based on the state of North Carolina’s Tax and Tag program, which combines the vehicle ad valorem tax collection with the state’s vehicle license renewal process. In FY 2022, the property tax rate decreased by a half-cent to $0.345. Despite the reduction in the property tax rate, Cary received $18.8 million in both real and personal property tax revenue this quarter, which is a 6% increase over the same period last year. In Q3 of FY 2022, Cary staff will know if this increase is due to timing of receipts or notable growth in the tax base.

The Other Taxes and Licenses category saw an increase of 25% compared with the prior year. This reflects an increase in occupancy tax revenue resulting from increased visitors to the area compared with reduced travel during the early pandemic in Q1 of FY 2021.

Although the revenue loss of about $8,000 cannot be seen in the summarized quarterly results, in Q1 the North Carolina legislature granted Cary the authority to not levy beer and wine license fees. To reduce the burden on Cary businesses and administrative staff, Cary sought this permission to eliminate data gathering, licensure, and a bureaucratic mandated fee schedule that generated only marginal revenue and required duplicate information for businesses that sell beer and wine.

Restricted intergovernmental revenues increased 100% compared with the prior year due to the increase in school resource officer revenue. Due to the pandemic’s impact on Wake County Public Schools in FY 2021, virtual learning replaced the need to have resource officers working at the schools; therefore, Wake County was not billed for these services. Since in-school instruction resumed, this revenue stream was restored.

The PRCR sales and services category increased well over 100% compared with Q1 of FY 2021, when the onset of the pandemic caused Parks, Recreation, and Cultural Resources (PRCR) to close facilities, rentals, and camps. Near the end of FY 2021, PRCR began to offer virtual camps and classes and started to safely reopen facilities, which led to a rebound in these revenues.

Solid waste sales and services increased slightly because the solid waste and recycling fees increased $1 from $19.50 to $20.50 per month to cover a higher percentage of the cost of the service.

Miscellaneous revenues declined by 88% compared with FY 2021. The decline reflects the timing of receipts of revenue from N.C. Department of Transportation. Year-to-date totals are expected to return to normal in Q2.

Non-operating revenues increased by over 100% in Q1 of FY 2022 compared with the same period last year primarily due to bond proceeds. Cary received $500,000 in bond premiums from the bond sale to cover the bond issuance expenditures in FY 2022.

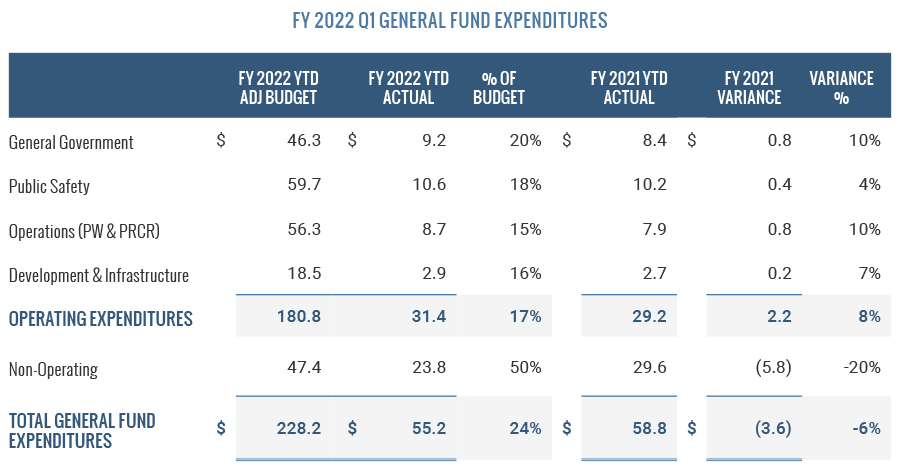

General Fund operating spending trends are slightly higher than FY 2021 but are consistent with budgetary expectations. Although total General Fund expenditures decreased 6% compared with the prior year, operating expenditures increased by 8% primarily due to increases in both general government and PRCR expenditures. In Q1 of FY 2021, PRCR programming ran well below typical levels, as Cary’s facilities remained closed to ensure citizen and employee safety during the early phases of the COVID-19 pandemic. This year, Q1 spending reflects a more typical experience, as Cary’s facilities have reopened and in-person PRCR programming has returned. Non-operating expenditures decreased 20% as a result of smaller budgeted General Fund transfers for operating and capital needs.

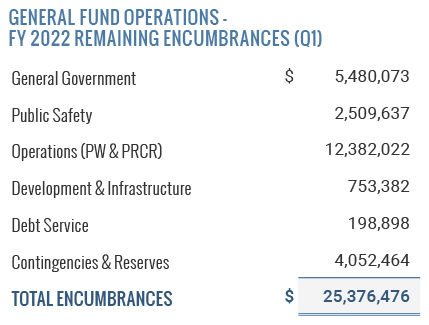

Encumbrances represent funds that have been reserved in Cary’s financial reporting system to satisfy a commitment to make a purchase. The following table shows the total outstanding encumbrances in the financial system that are remaining at the end of Q1.

After accounting for year-to-date spending and the encumbrances listed below, the General Fund has nearly $148 million of budgeted funds available for the remainder of the fiscal year.