GENERAL FUND

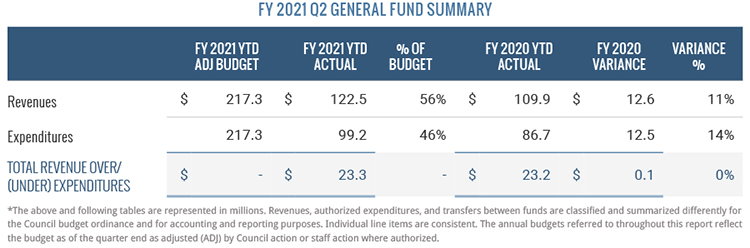

Overall, net results for Q2 are consistent with prior year’s second quarter. Revenues and expenditures have increased over 10%. Details on notable revenues and expenditures by category follow.

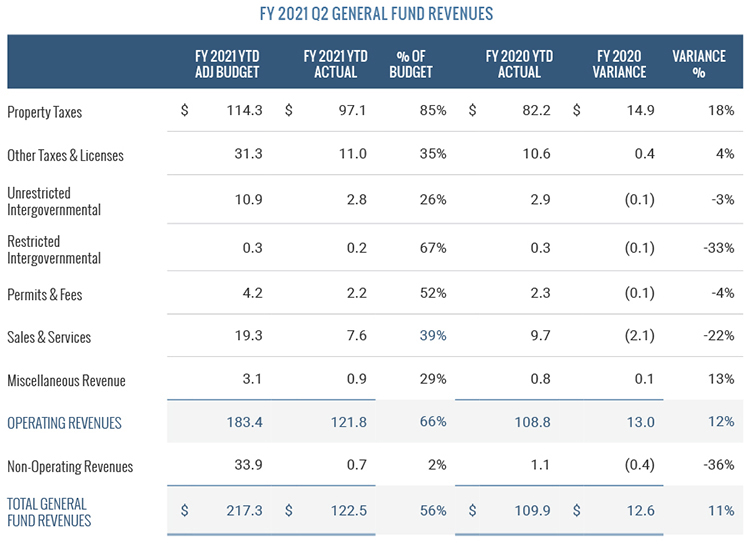

Overall, FY 2021 General Fund revenues are up $12.6 million, or 11%, over the same period in FY 2020. This is primarily due to the Wake County property tax revaluation that took effect January 1, 2020 in combination with Cary maintaining its $0.35 tax rate for the current fiscal year.

Operating Revenues

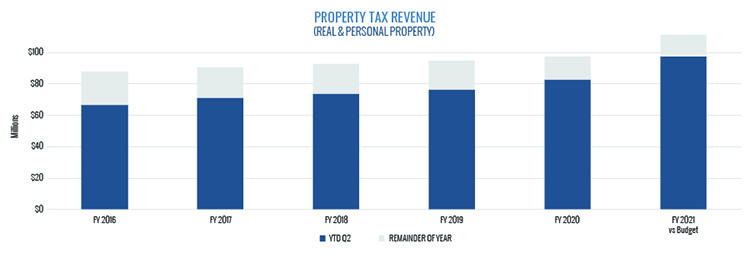

Property tax revenue is 53% of total budgeted revenue and is the largest revenue source for the General Fund. Taxes are based on an ad valorem tax levy on real and personal property. Real property are items such as land and buildings, while personal property are items such as vehicles and commercial business equipment. Real property taxes were billed in July 2020 and were due no later than January 5, 2021. Therefore, most real property tax revenue is received during Q2.

Personal property tax revenue, however, is collected throughout the year based on the State of North Carolina’s Tax and Tag program, which combines the vehicle ad valorem tax collection with the State’s vehicle license renewal process.

The FY 2021 budget for real property tax is $108.5 million. Q2 ended less than a week before the property tax due date, and by the end of the second quarter, Cary received $93.9 million, or 87%, of the real property tax budget. This is a 19% increase from FY 2020 that, as previously stated, is primarily due to the Wake County property tax revaluation and Cary maintaining its $0.35 tax rate.

The FY 2021 budget for personal property tax is $5.8 million.

As of Q2, Cary received $3.1 million, or 53%, of the personal property tax budget. Based on historical trends of the amount of property tax collected through Q2, both real and personal property tax revenues are expected to meet budget.

Sales tax revenue is 13% of budgeted General Fund revenue and is a component of the Other Taxes & Licenses category noted in the FY 2021 Q2 General Fund Revenues table. Sales tax revenue through Q2 is $700,000, or 7%, more than the same quarter of last fiscal year. This revenue stream is distributed to municipalities by the North Carolina Department of Revenue about two and a half months after the month when taxable sales occurred. Through Q2, Cary has received three distributions for July through September sales. The first three sales tax distributions appear to be consistent with FY 2020 Q2 results and suggest that the COVID-19 pandemic has not impacted the buying power of Wake County residents. At the time of adoption of the FY 2021 budget, the economic impacts of the pandemic could not be predicted, and the sales tax budget was set to accommodate a 20% decrease in sales tax revenue. Since this revenue has not declined as anticipated, the additional sales tax revenue will help offset other revenue shortfalls. This will primarily help offset the shortfalls in program revenues for Parks, Recreation, and Cultural Resources, which have been more severely impacted by the ongoing pandemic.

Collectively, Permits and Fees revenue decreased 4% when compared to prior year. However, permits for all types of construction increased 3% compared to prior year totals. Single-family, residential permits increased 65%, and permits for residential alterations and additions increased 9%. Most permit charges are based on the square footage associated with the permit. The revenue decrease reflects a decline in square footage of current construction activity despite the increase in the volume of permits. This decrease was anticipated during the FY 2021 budget process, and as a result, FY 2021 year to date permit and fee revenues are in line with budget.

Overall, Sales & Services revenue decreased by 22%. Sanitation fee revenue, which represents 62% of this category, is performing as expected with little or no impact from the pandemic. However, revenues declined in Parks, Recreation, and Cultural Resources (PRCR) due to the closure of community centers and the cancellation of in-person camps and events in response to the COVID-19 pandemic. The decline in PRCR revenue accounts for most of the $2.1 million decline in the Sales & Services category from the previous fiscal year. To address the challenges posed by the pandemic, PRCR has implemented virtual programs to engage the public. At the time of FY 2021 budget adoption, the end of pandemic restrictions could not be projected. PRCR program revenues were budgeted to decline 20% from the prior year. Given Cary’s values for safety, public gatherings, including PRCR programs are still on hold, and PRCR program revenues are not expected to meet budget. As mentioned above, the growth in sales tax revenue will likely cover this shortfall. Overall, the FY 2021 total revenues are expected to meet budget.

Non-Operating Revenues

Non-operating revenues through Q2 decreased 36% compared to the same period in FY 2020. This decrease is due in part to decreased investment earnings. For more information, see the Cash and Investments section.

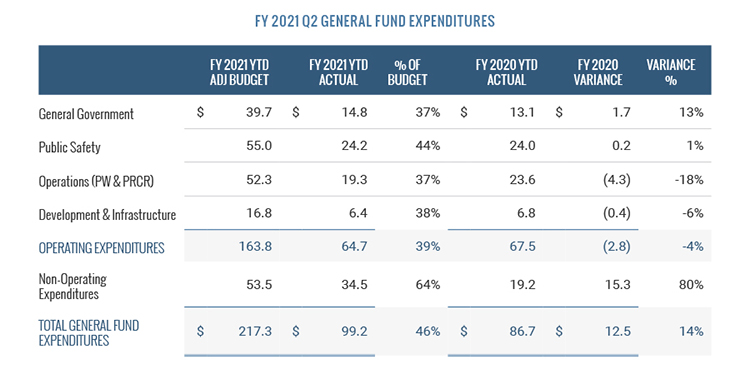

Overall, General Fund expenditures increased by 14%. This is primarily driven by the $15.3 million increase in non-operating expenditures for increases in transfers to capital projects. Reductions in operational expenditures slightly offset the increase in capital spending. More specifically, the 4% decrease in General Fund operating expenditures reflects the $4.3 million decrease in Operations (Public Works and PRCR) spending. For the safety of citizens, Cary’s facilities remain closed to the public, limiting normal operations and decreasing the need for temporary salaries and overtime. Conversely, spending in General Government increased $1.7 million due to the timing of software maintenance and renewals and capital lease equipment charges for computer hardware.

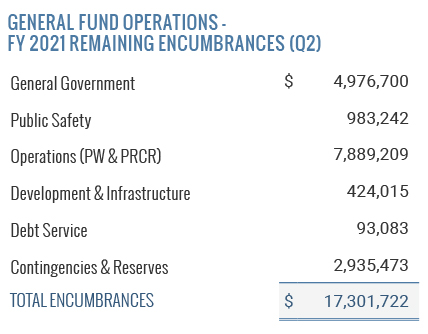

Encumbrances represent funds that have been reserved in Cary’s financial system to satisfy a commitment to make a purchase. The following table shows the total outstanding encumbrances in the financial system that remain at the end of Q2.

When including these encumbrance amounts with year-to-date spending, the General Fund has $100.8 million remaining in the Operations budget for the remainder of the year.