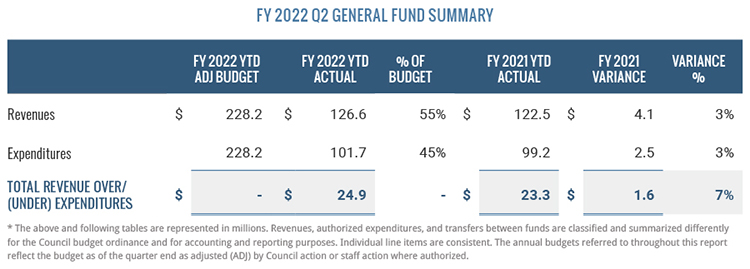

Overall net results for Q2 increased 7%, or $1.6 million, compared with the prior year’s second quarter.

Overall, FY 2022 General Fund revenues are up $4.1 million, or 3%, compared with the same period in FY 2021. This is primarily due to the strength of the economy and reduced pandemic impacts as reflected in increased sales tax revenues and the return of Parks, Recreation, and Cultural Resources sales and services revenue.

Operating Revenues

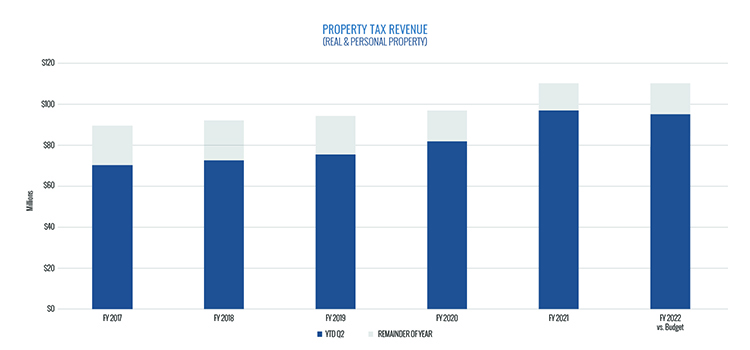

Property Tax revenue is 51% of total budgeted revenue and is the largest revenue source for the General Fund. Taxes are based on an ad valorem tax levy on real and personal property. Real property are items such as land and buildings, while personal property are items such as vehicles and commercial business equipment. Real property taxes were billed in July and due no later than January 5. Therefore, most real property tax revenue is received during Q2.

Personal property tax revenue, however, is collected throughout the year based on the state of North Carolina’s Tax and Tag program, which combines the vehicle ad valorem tax collection with the state’s vehicle license renewal process.

The FY 2022 budget for real property tax is $109.5 million. Q2 ended less than a week before the property tax due date, and by the end of the second quarter, Cary had received $92.3 million, or 84%, of the real property tax revenue budget.

The personal property tax budget for this fiscal year is $6.7 million, and as of Q2, Cary had received $3.1 million, or 46%. Based on historical trends and collections received so far, both real and personal property tax revenues are expected to meet budget.

Sales Tax revenue is 19% of budgeted General Fund revenue and is the second largest revenue source for the General Fund. Sales tax revenue through Q2 is $2.2 million, or 22%, more than the same quarter of last fiscal year. This revenue stream is distributed to municipalities by the N.C. Department of Revenue about two and a half months after the month when taxable sales occurred. Through Q2, Cary received three distributions for July through September sales representing the largest sales tax distributions in Cary’s history. This growth in sales tax revenue is reflective of significant retail sales, the current strength of the economy, and rising prices in some sectors.

Collectively, Permits and Fees revenue increased 27% when compared with last year. Permits for all types of construction increased 7% compared with prior year totals.

However, the most notable increase in permits is from non-residential additions and alterations, which increased 29% from the prior year. More information on the specific projects driving this increase can be found in the SHAPE section.

Parks, Recreation, and Cultural Resources sales and services increased well over 100% compared with Q2 of FY 2022. During most of FY 2021, PRCR facilities were non-operational in response to the COVID-19 pandemic. However, toward the end of FY 2021, PRCR safely reopened facilities and began offering virtual camps and classes, which has led to the significant increase in revenues.

Non-operating revenues through Q2 increased 57% compared with the same period in FY 2021. This increase is due to bond premiums received from the Q1 bond sale to cover the bond issuance costs.

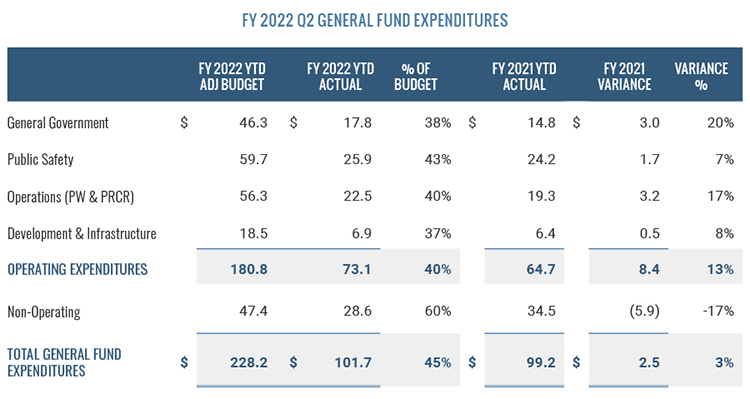

Overall, General Fund expenditures increased by 3% compared with last year’s Q2 results. Operating expenditures were up 13%, while non-operating expenditures were down 17%. Operating expenditure increases are based on a return to more typical PRCR programming and facility operations as well as pandemic-related expenses, which continue to impact General Government service areas, like Human Resources. Non-operating expenditures decreased 17% as a result of smaller budgeted General Fund transfers for operating and capital needs.

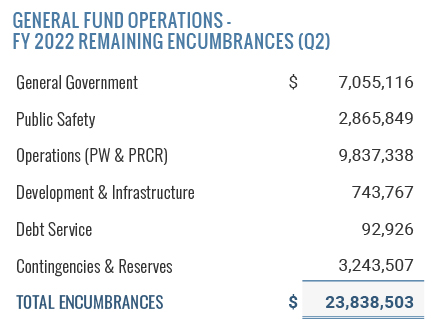

Encumbrances represent funds that have been reserved in Cary’s financial system to satisfy a commitment to make a purchase. The following table shows the total outstanding encumbrances in the financial system that remain at the end of Q2. When including these encumbrance amounts with year-to-date spending, the General Fund has nearly $103 million of budgeted funds available for the remainder of the fiscal year.