General Fund

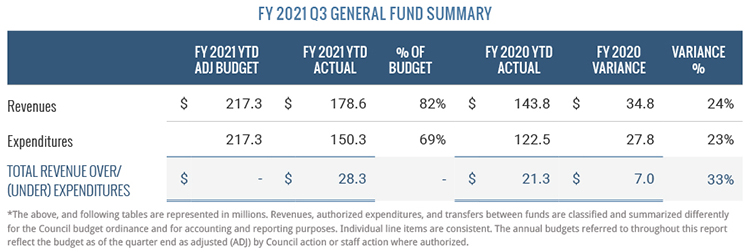

Overall, net results for the General Fund have rebounded significantly since Q3 of last year with an increase of 33%. Conversely, net results in Q3 of FY 2020 were down 9% compared to the same period in FY 2019. This increase in net results is directly related to the strengthening of the economy. Details on notable revenues and expenditures by category are listed in the following section.

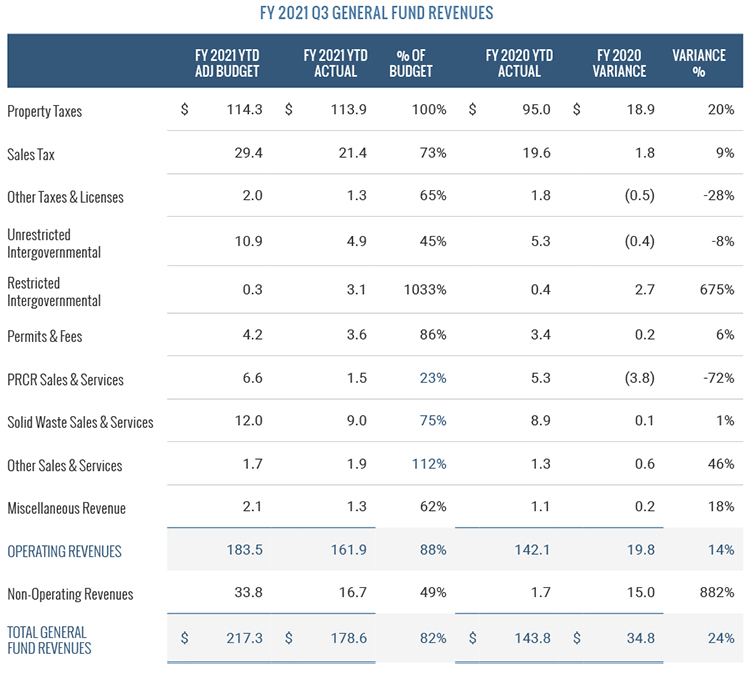

Overall, FY 2021 General Fund revenues are up $34.8 million, or 24%, over the same period in FY 2020. This is primarily due to the property tax base growth of 20%, a result of Wake County property tax revaluation while maintaining Cary’s $0.35 tax rate this fiscal year. Additionally, there is a $15 million increase in non-operating revenues due to the refinancing of the 2014 general obligation bonds. When debt is refinanced, new debt proceeds are reported as revenue. These new proceeds offset the use of funds to pay off the original debt. The payment toward the refinanced 2014 bonds is reported as additional debt expenditures in non-operating expenditures.

Operating Revenues

Property tax revenue is 53% of total budgeted revenue and is the largest revenue source for the General Fund. Property taxes are based on an ad valorem tax levy on real and personal property. Real property are items such as land and buildings, while personal property are items such as vehicles and commercial business equipment. Real property taxes were billed in July 2020 and were due no later than January 5, 2021. Given this tax due date, most real property tax revenue is received in Q2. Personal property tax revenue, however, is collected throughout the year based on the State of North Carolina’s Tax and Tag program, which combines the vehicle ad valorem tax collection with the State’s vehicle license renewal process.

The FY 2021 budget for property tax is $114.3 million, and as of Q3, Cary received $113.9 million. This is a 20% increase from FY 2020, which is primarily due to the 20% growth in the Wake County tax base following the Wake County property tax revaluation while maintaining Cary’s $0.35 tax rate. Based on historical trends, property tax is expected to meet or slightly exceed the property tax budget.

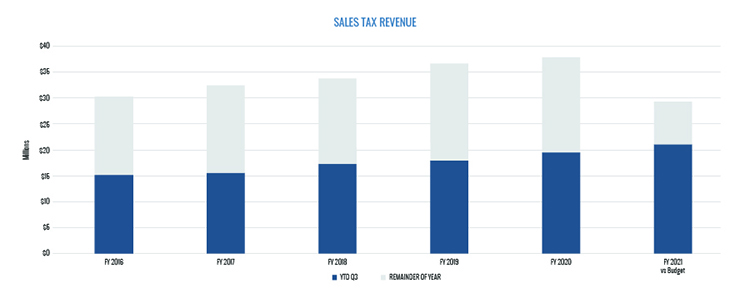

Sales tax revenue is 14% of total budgeted revenue and is the second largest revenue source for the General Fund. As of Q3, this revenue is $1.8 million, or 9%, above Q3 of FY 2020. This revenue stream is distributed to municipalities by the North Carolina Department of Revenue about two and a half months after the month when taxable sales occurred. Cary received six distributions for July through December sales. The six sales tax distributions of FY 2021 are outpacing prior year’s Q3 results. This trend is not unique to Cary. The North Carolina League of Municipalities reported that total state sales tax distributions increased 6% compared to Q3 of FY 2020. This suggests that the COVID-19 pandemic has not impacted the buying power of residents as initially forecasted.

Current sales tax projections suggest this revenue will end the fiscal year at $40.6 million, which would be a 49% increase over the FY 2021 budget for sales tax and a 7% increase over FY 2020 actual results. When Cary adopted the FY 2021 budget, the economic impacts of the pandemic could not be predicted, and the sales tax budget was set to accommodate a 20% decrease in sales tax revenue. Since this revenue did not decline as anticipated, the additional sales tax revenue will help offset other revenue shortfalls, primarily for Parks, Recreation, and Cultural Resources (PRCR), which has been more severely impacted by the pandemic.

Overall, Other Taxes and Licenses decreased 28% when compared to Q3 of the prior year. The COVID-19 pandemic significantly affected the tourism and travel industries. Due to this, the occupancy tax Cary receives from travelers renting hotel rooms decreased 59% compared to the prior year. While the FY 2021 budget accounted for a significant decrease in this revenue source, current occupancy tax projections suggest that this revenue will not meet reduced budget assumptions.

Combined Restricted and Unrestricted Intergovernmental revenues increased by 40%. Decreases in revenues associated with utility sales tax and electric and natural gas were offset by $3 million in Coronavirus Aid, Relief, and Economic Security (CARES) Act funding received year-to-date.

Permits and Fees revenue increased 6% compared to Q3 of the prior year. The growth seen in this revenue source could be interpreted as a positive effect of pandemic-driven lifestyle changes with citizens choosing to invest in home improvements. Permit activity increased significantly in March as year-to-date permits for all types of construction increased 4% compared to this same time last year. Multi-family permits, including those for the Glenaire expansion and portions of Novel Cary, a luxury multi-family community in western Cary, almost doubled through Q3 of FY 2021 compared to FY 2020.

A portion of permit fees are based on the square footage associated with the project. The overall revenue increase in this category is directly tied to the square footage with multi-family construction activity. With an increase in March’s permitting activity, permits and fees revenue is now expected to meet or exceed budget.

The Sales and Services category is made up of PRCR programming revenues, Solid Waste Sales and Services, and Other Sales and Services. The combined Sales and Services category decreased 20%. Solid Waste revenue, the largest revenue in Sales and Services, is performing slightly above expectations with little or no impact from the pandemic. However, revenues declined by $3.8 million in PRCR due to the closure of community centers and the cancelation of many camps and events in response to the pandemic. As COVID-19 cases decrease across the state, registrations for sports, shelter rentals, and outdoor in-person classes return. The decline in PRCR revenue is slightly offset by an increase in the Other Sales and Services category, which is mainly due to an increase in the sale of assets.

Non-Operating Revenues

Non-Operating revenues through Q3 increased 882% compared to the same period in FY 2020. This increase reflects the use of $15.3 million of bond proceeds to refinance Cary’s 2014 general obligation bonds.

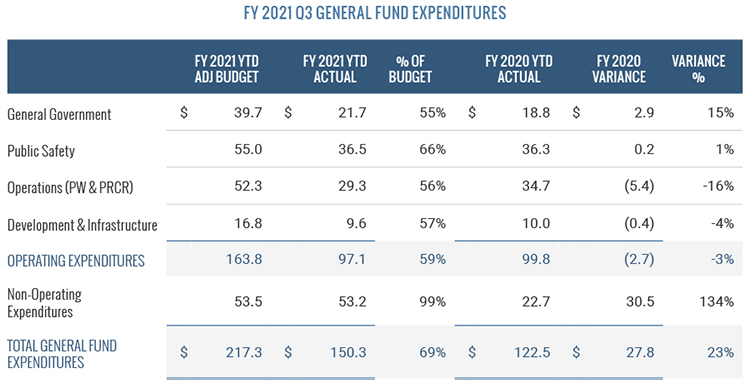

Overall, General Fund expenditures increased 23%. This is primarily driven by the $30.5 million increase in non-operating expenditures for transfers to capital project spending, as well as $15.3 million in expenditures to refinance the 2014 general obligation bonds. A reduction in operational expenditures due to the pandemic slightly offset the increase in non-operating expenditures. More specifically, the 3% decrease in General Fund operating expenditures is primarily driven by a $5.4 million decrease in operations, including Public Works and PRCR, spending. For the safety of our citizens, Town Hall and some recreational facilities remained closed to the public, limiting normal operations and decreasing the need for temporary salaries and overtime. Conversely, spending in General Government increased $2.9 million due to the timing of payment for software maintenance, consulting services, and software licenses.

Encumbrances represent funds that have been reserved in Cary’s financial system to satisfy a commitment to make a purchase. The following table shows the total outstanding encumbrances remaining in the financial system at the end of Q3. When these encumbrance amounts are combined with year-to-date spending, the General Fund has an adequate amount of $52.9 million remaining in the operations budget for the remainder of the year.