General Fund

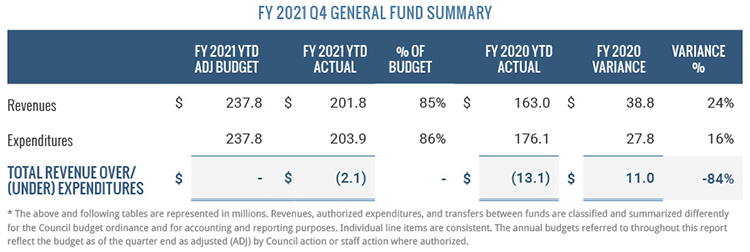

Preliminary net Q4 General Fund results reflect $2.1 million more expenditures than revenues. As in years past, significant revenue sources will not be received and attributed to FY 2021 until late summer. Sales tax is the primary example because there is a two-and-a-half-month lag between taxes collected at the point of sale in June and receipt of actual Q4 sales tax revenue in September. Staff estimates that Cary will receive approximately $9.5 million of additional sales tax revenue that remains to be recorded.

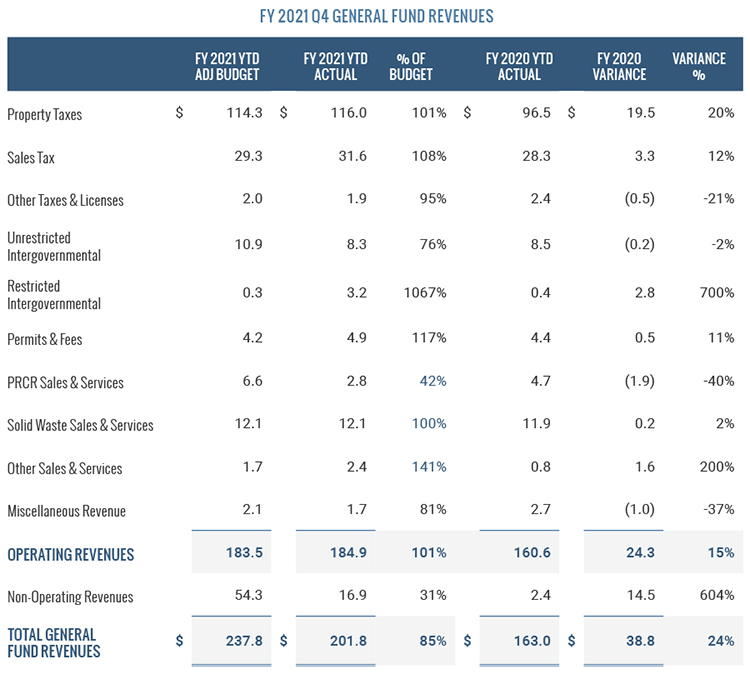

Overall, FY 2021 General Fund revenues are up $38.8 million, or 24%, over the same period in FY 2020. This is primarily due to an increase in property tax and sales tax revenues. Additionally, there is a $14.5 million increase in non-operating revenues, which is mainly due to the refinancing of the 2014 general obligation bonds. When debt is refinanced, revenue in the form of debt proceeds is received that equally offsets the new debt expense.

Operating Revenues

Property Tax revenue is 48% of total budgeted revenue and is the largest revenue source for the General Fund. Property taxes are based on an ad valorem tax levy on real and personal property. Real property is items such as land and buildings while personal property is items such as vehicles, boats, airplanes, and commercial business equipment. Real property taxes were billed in July 2020 and due no later than Jan. 5, 2021. Therefore, most real property tax revenue is received during Q2. Most personal property tax revenue, however, is collected throughout the year based on the state of North Carolina’s Tax and Tag program, which combines the vehicle ad valorem tax collection with the state’s vehicle license renewal process.

The FY 2021 budget for property tax is $114.3 million, and as of Q4, Cary received $116 million. This is a 20% increase from FY 2020, which is primarily due to the Wake County property tax revaluation that took place on Jan. 1, 2020, and Cary maintaining its $0.35 tax rate in FY 2021.

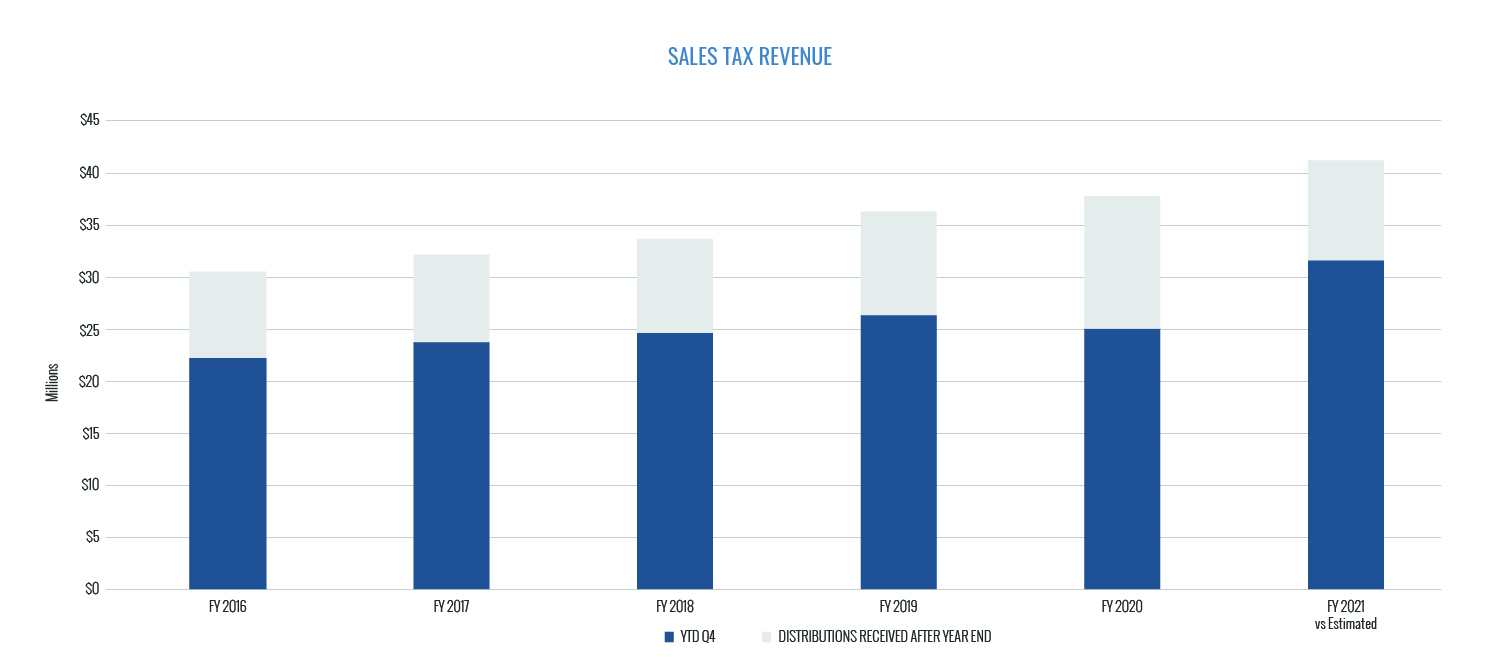

Sales Tax revenue is 12% of total budgeted revenue and is the second largest revenue source for the General Fund. This revenue through Q4 is $3.3 million, or 12%, more than Q4 of FY 2020. This revenue stream is distributed to municipalities by the N.C. Department of Revenue about two and a half months after the month when taxable sales occurred. Cary received nine distributions for July through March sales, and these have outpaced the prior year’s Q4 results despite the COVID-19 pandemic.

Current sales tax projections suggest this revenue will end the fiscal year at $41.1 million, which would be a 40% increase over the FY 2021 budget for sales tax and a 9% increase over FY 2020 actual results. When Council adopted the FY 2021 budget, the economic impacts of the pandemic could not be predicted, and the sales tax budget was set to accommodate a 20% decrease in sales tax revenue. Since this revenue did not decline, the additional sales tax revenue helped offset other revenue shortfalls, primarily for PRCR, which has been more severely impacted by the pandemic due to facility closures and program cancellations.

Overall, Other Taxes and Licenses decreased 21% when compared with Q4 of the prior year. The COVID-19 pandemic significantly affected the tourism and travel industries. Due to this, the occupancy tax Cary receives from travelers renting hotel rooms decreased 46% compared with the prior year. While the FY 2021 budget accounted for a significant decrease in this revenue source, current occupancy tax projections suggest that this revenue will not meet even reduced budget assumptions. With COVID-19 restrictions being lifted across the nation, Cary is projecting stronger occupancy tax revenues for FY 2022.

Combined Restricted and Unrestricted Intergovernmental revenues increased 29%. Decreases in revenues associated with utility sales tax and electric and natural gas were offset by $3 million in Coronavirus Aid, Relief, and Economic Security (CARES) Act funding received.

Permits and Fees revenue increased 11% year-to-date when compared with the prior year and has exceeded the budget for FY 2021. The growth seen in this revenue source could be directly related to citizens choosing to invest in home improvements. The increase in this revenue category is mostly due to building permits, which increased $406,000, or 15%, compared with the prior year. The largest percentage increase, 66%, was for the number of multi-family new construction permits. Multi-family new construction square footage also increased more than 500%. A portion of permit fees is based on the square footage associated with the project. The square footage associated with multi-family permits was the major contributor to the revenue increase.

Overall, total permits increased 12% over prior year numbers and are trending above both the three-year and five-year year-to-date averages by 6% each. Standard inspection fees are included in permit costs and are charged separately only for certain trade inspections or when reinspections are needed. While total inspections increased 2% over prior year levels, inspection fee revenue declined from prior year levels due to a decrease in street and commercial inspections.

The Sales and Services category is made up of PRCR programming revenues, solid waste sales and services, and other sales and services. The combined Sales and Services category decreased by less than 1%. Solid waste revenue, the largest revenue in Sales and Services, has $12.1 million recorded through June 30. This revenue met budget with little to no impact from the pandemic.

Revenues declined by $1.9 million in PRCR compared with FY 2020 due to the closure of indoor facilities and the canceling of many in-person programs and events in response to the pandemic. The prior year revenues also decreased due to the pandemic, which affected Q4 of FY 2020. In Q4 of FY 2021, sports, shelter rentals, summer camps, and outdoor in-person classes reopened with limited capacity. Cary Tennis Park, WakeMed Soccer Park, and USA Baseball hosted various tournaments this quarter that brought back spectators and ticket revenue. While the pandemic impacted PRCR activities severely throughout the fiscal year, the department adapted by creating virtual programming and offering outdoor and socially distant sports and classes. An increase in sales of assets offset the decline in PRCR revenue.

Miscellaneous revenue through Q4 decreased 37% compared with the same period in FY 2020. This decrease is primarily due to the timing of receipts from Wake County and N.C. Department of Transportation that were received by June 30 in FY 2020.

Non-operating revenues through Q4 increased by more than 100% compared with the same period in FY 2020, reflecting the receipt of $15.4 million of debt proceeds generated by refinancing Cary’s 2014 general obligation bonds. These proceeds offset the accompanying $15.4 million increase in debt-related expenditures.

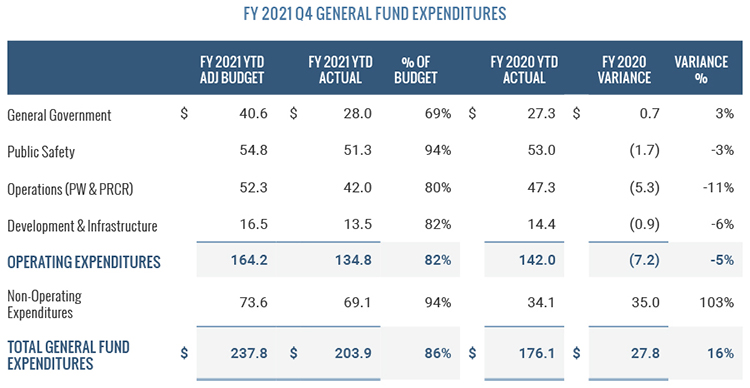

Overall, General Fund expenditures increased 16%. This is primarily driven by a $35 million increase in non-operating expenditures for increases in transfers for capital project spending as well as increased debt payments associated with the refinancing of the 2014 general obligation bonds.

FY 2021 General Fund operating expenditures are 18% less than budgeted expenditures and 5% less than FY 2020 year-to-date actuals. For the safety of citizens and staff, Town Hall and other Town-owned facilities and venues remained closed to the public for most of FY 2021, limiting normal operations and decreasing the need for temporary salaries and overtime.

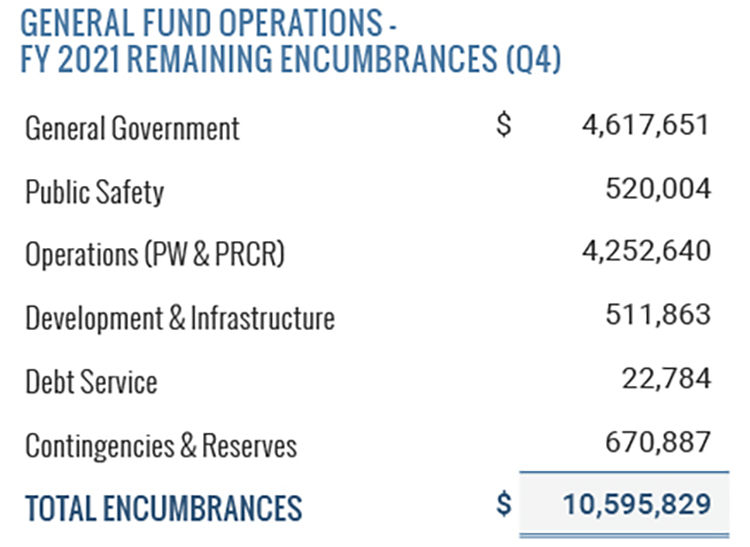

Encumbrances represent funds that have been reserved in Cary’s financial system to satisfy a commitment to make a purchase. The following table shows the total outstanding encumbrances in the financial system that are remaining at the end of Q4. After accounting for year-to-date spending and the encumbrances listed below, the General Fund has $23.3 million remaining in the operations budget for expenditures not yet recorded as of this report.